|

|||||

|

FEDERAL NEWS

CDC guidance eliminates most mask requirements for fully vaccinated

On May 13, the Centers for Disease Control and Prevention (CDC) issued new guidance permitting all fully vaccinated individuals to go without a mask for most indoor activities and for outdoor activities in crowds such as sports events or concerts. Fully vaccinated people continue to be encouraged to wear masks when traveling or in health care facilities. The new position expands CDC guidance issued late last month permitting fully vaccinated individuals to go maskless when outdoors except when at large events. CDC Director Dr. Rochelle Walensky acknowledged the significance of the new guidance, saying “This is an exciting and powerful moment.”

The news came during the same week when the Food and Drug Administration (FDA) and CDC approved the Pfizer vaccine for children ages 12-15. Pfizer expects to seek full federal approval for individuals of all ages by the fall and Moderna reported it will soon release clinical trial results finding its product is also effective for children.

HHS confirms antidiscrimination requirements apply to LGBTQ+

On May 10, the U.S. Department of Health and Human Services (HHS) announced it will be enforcing antidiscrimination rights in health care delivery established by the Affordable Care Act (ACA) for the LGBTQ+ community. Antidiscrimination protections for these individuals had been withheld by the previous administration based upon its definition of “on the basis of sex,” which it said did not cover these individuals.

HHS puts hospitals on notice regarding transparency rules

Published reports indicate the Biden Administration is sending notices to hospitals directing compliance with rules requiring them to publicly post negotiated payment rates by health plans. The regulations became effective Jan. 1 but recent analyses find few hospitals are following the rules, including one report concluding 65% of the largest systems are “unambiguously noncompliant.” The warning letter gives hospitals 90 days to comply. Continued noncompliance would lead to a $300 fine for each day the hospital is not posting these data and the listing of its name on a federal website, which is intended to shame the facility into doing so. The new requirements were finalized by the previous administration, but the Biden Administration’s action indicates it is supporting them. Similar rules for health plans go into effect next January.

New York State Releases Final Model Sexual Harassment Prevention Training Program and Policy

New York State has released finalized versions of its model sexual harassment prevention training program and model sexual harassment prevention policy. As a reminder, within 12 months of October 9, 2018, and annually thereafter, all New York employers must provide training to all employees using either the state’s model training program or one that equals or exceeds the state program. Additionally, starting October 9, 2018, all New York employers must adopt either the state’s model sexual harassment prevention policy or one that equals or exceeds the standards of the state policy, and provide it to employees in writing.

Visit the New York Sexual Harassment page of your HR library for more information.

IRS RELEASES NEW ACA ADJUSTED FEES FOR 2017

DEC 22 JOANNA KIM-BRUNETTI AFFORDABLE CARE ACT, IRS

The IRS has released its adjusted figures for certain fees coming into the new year. The Patient-Centered Outcomes Research Institute (PCORI) fee being one of them. The fee was started under the ACA for advancements in comparative clinical effectiveness research, and while the fee increases have been nominal over the years PCORI has been in place, there is still an increase in the fee, which is based on per average number of lives that are covered by the plan or policy.

For both policies and plans ending on or after October 1, 2016 and before October 1, 2017, the fee has been adjusted to $2.26 per life. Compare that to the previous year’s $2.17 per life (2015/2016), $2.08 per for 2014/2015, and $2 per life for 2013/2014. That’s roughly an 8.5 cent increase each year since 2013. Said fee for the coming year must be paid by July 31, 2017 along with the filing of Form 720.

Another fee, the Transitional Reinsurance Fee, saw great decreases over the years before being ceased for 2017. Created in an effort to provide the marketplace exchanges with reinsurance, the Transitional Reinsurance Fee for 2016 was $27 per covered life. In 2015 it was $44, and in 2014 was $63. Per the Department of Health and Human Services (HHS), these records must be retained for a minimum of ten years despite the fee ending in 2017.

There are two options for payment including a lump sum due by January 17, 2017 or broken up into two payments: one at $21.60 per covered life due by January 17, 2017 and the second at $5.40 per covered life, due by November 15, 2017. To make payments online, click

here.

By Topic: Workplace Posters

Topics

Overview

Some of the statutes and regulations enforced by the U.S. Department of Labor (DOL) require that notices be provided to employees and/or posted in the workplace. DOL provides free electronic copies of the required posters and some of the posters are available in languages other than English.

Please note that posting requirements vary by statute; that is, not all employers are covered by each of the Department’s statutes and thus may not be required to post a specific notice. For example, some small businesses may not be covered by the Family and Medical Leave Act and thus would not be subject to the Act’s posting requirements.

The elaws Poster Advisor can be used to determine which poster(s) employers are required to display at their place(s) of business. Posters, available in English and other languages, may be downloaded free of charge and printed directly from the Advisor. If you already know which poster(s) you are required to display, see below to download and print the appropriate poster(s) free of charge.

Please note that the elaws Poster Advisor provides information on federal DOL poster requirements. For information on state poster requirements please visit state Departments of Labor.

FOR MORE INFORMATION, PLEASE CONTACT US AT HILLERLEE@AOL.COM

ECFC Statement on Washington Post Editorial “United Against the Cadillac Tax”

Please read the editorial statement from the Washington Post below that explains WHY the Cadillac Tax poses a steep financial threat to employers, employees and consumerism, which helps to control healthcare spending.

http://www.ecfc.org/files/ECFC_Statement_on_WaPo_Editorial_final.pdf

ACA 29TH SET OF FAQS – 2015 DECEMBER

The Departments of Labor, Treasury, and Health and Human Services (collectively, the Departments) have issued the 29th set of Affordable Care Act (“ACA”) frequently asked questions (“FAQs”).

This time, the Departments tackle various questions on the preventive care mandate, wellness programs, and medical necessity determinations under the Mental Health Parity and Addiction Equity Act of 2008. Unless otherwise noted, this guidance is effective as of October 23, 2015.

Preventive Care

A non-grandfathered group health plan must provide coverage for in-network preventive items and services and may not impose any cost-sharing requirements (such as a copayment, coinsurance, or deductible) with respect to those items or services. The FAQs address some of those preventive items and services. Lactation counseling Comprehensive prenatal and postnatal lactation support, counseling, and equipment rental are part of the ACA’s mandated preventive care requirements. This includes lactation counseling. FAQs 1-4 address a number of issues related to lactation counseling: • Plans are required to provide a list of lactation counseling providers within a network. This requirement is generally met through providing the SBC, which includes an Internet address for obtaining a list of the network providers.

This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional.

Further, ERISA requires a group health plan to provide an SPD that, among other things, provides information on providers including a description of any provider networks and how to obtain a provider list without charge. • If a plan does not have in its network a provider who can provide lactation counseling services, the plan must cover the item or service when performed by an out-of-network provider without cost sharing. • If a state does not license lactation counseling providers, then, subject to reasonable medical management, lactation counseling must be covered without cost sharing by the plan when it is performed by any provider acting within the scope of his or her license or certification under applicable state law (e.g., a registered nurse). • It is not a reasonable medical management technique to limit coverage for lactation counseling to services provided on an in-patient basis (e.g., in a hospital setting). Moreover, coverage for lactation support services without cost sharing must extend for the duration of the breastfeeding. Breastfeeding equipment Under the preventive care mandate, the rental or purchase of breastfeeding equipment must be covered without cost-sharing. A plan may not require individuals to obtain breastfeeding equipment within a specified time period (e.g., 6 months from the date of delivery) in order for the equipment to be covered without cost sharing. Additionally, the coverage extends for the duration of breastfeeding, provided the individual remains continuously enrolled in the plan or coverage.

Weight management exclusions Screening for obesity in adults is a preventive service. Additionally, the guidelines currently recommend, for adult patients with a body mass index (“BMI”) of 30 kg/ m2 or higher, intensive, multi-component behavioral interventions for weight management. While plans and issuers may use reasonable medical management techniques to determine the frequency, method, treatment, or setting for a recommended preventive service, to the extent not specified in the recommendation or guideline, plans are not permitted to impose general exclusions that would encompass recommended preventive services. Colonoscopies FAQs 8-9 clarify that if the colonoscopy is scheduled and performed as a preventive screening procedure, it is not permissible for the plan to impose cost-sharing on a required specialist consultation or any pathology exam or biopsy in connection with a preventive colonoscopy. This clarifying guidance is effective for plan years that begin on or after January 1, 2016.

Eligible organizations and contraceptive services FAQ 9 outlines the two methods a qualifying non-profit or closely held for-profit employer with a self-insured group health plan can use to claim an accommodation: • Complete EBSA Form 700 and provide the form to the third party administrator (TPA): http://www.dol.gov/ ebsa/pdf/preventiveserviceseligibleorganizationcertificationform.pdf; or • Provide notice of the objection to HHS: https:// www.cms.gov/CCIIO/Resources/Regulations-andGuidance/Downloads/Model-Notice-8-22-14.pdf. This document is designed to highlight various employee benefit matters of general interest to our readers. It is not intended to interpret laws or regulations, or to address specific client situations. You should not act or rely on any information contained herein without seeking the advice of an attorney or tax professional. The accommodation generally relieves the employer from any obligation to contract, arrange, or pay for the objectionable contraceptive and that has the legal effect of designating the third party administrator (“TPA”) as the ERISA plan administrator responsible for separately providing payments for those services. Note, the Supreme Court granted review of 7 cases contesting the contraceptives services mandate under the ACA, mainly centered on this accommodation process. The Court is expected to hear oral arguments in late March of 2016 with a decision likely in June.

BCRA Testing FAQ 10 states that women found to be at increased risk, using a screening tool designed to identify a family history that may be associated with an increased risk of having a potentially harmful gene mutation, must receive coverage without cost sharing for genetic counseling and, if indicated, testing for harmful BRCA mutations. This is true regardless of whether the woman has previously been diagnosed with cancer, as long as she is not currently symptomatic of or receiving active treatment for breast, ovarian, tubal, or peritoneal cancer.

Wellness Programs Non-financial rewards FAQ 11 provides that if a group health plan offers non-financial (or in-kind) incentives (e.g., gift cards, thermoses, sports gear) to participants who adhere to a health-contingent wellness program, the program must comply with HIPAA’s 5-factor test.

Obamacare Penalties Will Cost More Than Health Coverage for Millions Fines for skipping health insurance are going up.

Obamacare is about to test how well people respond to economic incentives.

About 3.5 million Americans who are uninsured today could get health coverage in 2016 for less than what they’ll pay in penalties under Obamacare, according to a new analysis. QUICKTAKE The Individual Mandate That’s because the Affordable Care Act’s fines for skipping health insurance will rise next year. On average, people currently uninsured would have to pay $969 in 2016, up from $661 this year, according to the report by the Kaiser Family Foundation. The penalties are rising to 2.5 percent of income or a flat dollar amount of $695 per adult, whichever is higher. That’s compared with 2 percent of income or $325 per adult this year.

About 11 million people are eligible for coverage but haven’t bought it. The big question is whether the steeper fines will prod more of them into the market. “That’s where the mandate matters the most, because it aims to bring healthy people into the risk pool, which will help keep premiums down,” says Larry Levitt, senior vice president at the Kaiser Family Foundation and one of the report’s authors. The new insurance markets created by Obamacare in 2014 need healthy people to enroll in order to be sustainable. Last month the largest U.S. health insurer, UnitedHealth Group, said it might withdraw from the Obamacare market entirely after next year because of mounting losses. More than 2 million people selected Obamacare plans in the first month after open enrollment began on Nov. 1, according to federal statistics, including 700,000 new to the marketplace. (The tally counts 38 states that use the federal marketplace, and omits states like New York and California with their own enrollment systems.) Obama administration officials have said they expect about 10 million people to sign up in the enrollment period that closes at the end of January, only a small increase over the current year. Obamacare relies on carrots and sticks to get people to enroll in health plans. Subsidies bring down the price of insurance, while the penalties discourage people from forgoing coverage. For many people, paying the penalty might be a rational choice, because it’s often still less money than what the cheapest health plan costs. Kaiser estimates that there are about 7 million uninsured people in this circumstance. But then there’s another group of about 3.5 million uninsured who are eligible for coverage, and could enroll in the least expensive health plans for less than what they’ll pay in penalties, or for no cost at all after subsidies. That’s roughly equivalent to the population of Connecticut. And they’d have to defy economic logic to remain uninsured next year. There are several reasons that they might. First, the penalties aren’t calculated until tax time: Fines people incur for not having health insurance in 2016 won’t be levied until they file their taxes in 2017. A lot of people who are eligible for subsidies to reduce the cost of coverage don’t realize it, Levitt says. And the administration has soft-pedaled the penalties, because they’re among the least popular parts of the law. “The mandate could be a very effective tool to encourage people to sign up,” Levitt says, “but the politics of it aren’t great.”

DOL RELEASES NEW FMLA FORMS

In the instructions to the health care provider on the certification for an employee’s serious health condition, the DOL has added the following simple instruction:

Do not provide information about genetic tests, as defined in 29 C.F.R. § 1635.3(f), genetic services, as defined in 29 C.F.R. § 1635.3(e), or the manifestation of disease or disorder in the employee’s family members, 29 C.F.R. § 1635.3(b).

DOL added similar language to the other medical certification forms as well. For easy reference, here are the links to the new FMLA forms:

- WH-380-E Certification of Health Care Provider for Employee’s Serious Health Condition http://www.dol.gov/whd/forms/WH-380-E.pdf

- WH-380-F Certification of Health Care Provider for Family Member’s Serious Health Condition http://www.dol.gov/whd/forms/WH-380-F.pdf

- WH-381 Notice of Eligibility and Rights & Responsibilities http://www.dol.gov/whd/forms/WH-381.pdf

- WH-382 Designation Notice http://www.dol.gov/whd/forms/WH-382.pdf

- WH-384 Certification of Qualifying Exigency For Military Family Leave http://www.dol.gov/whd/forms/WH-384.pdf

- WH-385 Certification for Serious Injury or Illness of Current Servicemember – for Military Family Leave http://www.dol.gov/whd/forms/WH-385.pdf

- WH-385-V Certification for Serious Injury or Illness of a Veteran for Military Caregiver Leave http://www.dol.gov/whd/forms/wh385V.pdf

The forms also can be accessed from this DOL web page.

Click on the link below: http://www.dol.gov/whd/fmla/2013rule/militaryForms.htm

IRS SECTION 6056 Q & A

PROPOSED “SURPRISE MEDICAL BILL LAW” IN NY TO PROTECT OUT OF NETWORK MYSTERY BILLS.

The first set of proposed regulations has been issued to New York’s “Surprise Medical Bill Law.” The law is intended to provide consumer protections from certain medical bills received from out-of-network health care providers. Health care providers must be aware of three essential impacts of this law.

-

- Patients are only responsible for in-network cost-sharing responsibilities in the emergency room. After March 31, insured patients will only be financially responsible for their in-network cost-sharing responsibilities (i.e., copayments and deductibles) for services rendered in the emergency room, regardless of whether those services were provided by in-network or out-of-network physicians. Physicians must submit their bills directly to the patient’s health plan and negotiate reimbursement. Disputes regarding reimbursement may be submitted to the IDRE.

-

- Patient disclosures and increased transparency. Once in effect, the law requires health care providers to disclose information to patients such as: which health plans a provider participates with, the provider’s hospital affiliations, anticipated charges, and the names and contact information of any other professionals that may be involved in the patient’s care and from whom the patient may receive a bill for services (such as anesthesiologists or pathologists) so that the patient may learn of those providers’ network status. Hospitals must also post information for patients, such as a list of charges and the health plans that the hospital and its physician-employees participate in. Under the proposed regulations, health plans must also disclose information to its insureds on “surprise bills” and the independent dispute resolution process.

- Failure to provide required patient disclosures and obtain consents will result in “Surprise Bills” and limitations on charges to patient. Outside the emergency room setting, insured patients must receive disclosures as to a health care provider’s participation status with the patients’ health plan and must explicitly consent to referrals to out-of-network providers. The proposed regulations clarify that, in this context, “providers” include non-physician professionals and entities such as physical therapists, laboratories and home care agencies. The proposed regulations also clarify that for these purposes “referrals” include 1) services performed by non-participating providers in the participating physician’s office or practice during the course of the same visit, 2) a specimen that is taken from a patient in the participating physician’s office and sent to a non-participating laboratory or pathologist, or 3) any services performed by a non-participating health care provider when referrals are required under the insured’s contract. Failure to provide such disclosures and obtain such consents will result in a bill presented by such providers to constitute a “surprise bill” and in turn the patient will only be responsible for the in-network cost-sharing responsibility. Such providers will be required to negotiate payment directly with the patient’s health plan and any disputes will be subject to the IDRE process.

Skinny Plans and Minimum Value: Do these plans really pass the test?

D&S Agency, A UBA Partner Firm

There is a lot of buzz in the market right now as employers are implementing their plans for the upcoming year. Many employers are looking at ways to keep their costs for medical coverage low, but still meet the requirements of the Patient Protection and Affordable Care Act (PPACA). These plans, often referred to as ”skinny plans,” may only cover preventive services or may cover everything but inpatient or outpatient hospital services.

Since these plans will meet the minimum essential coverage requirement, as long as they are employer sponsored plans, they will allow employers to not be penalized under the “A” fine of $2,000 per employee less the first 30.

However, the lingering question remains about whether they meet minimum value. The plan that only covers preventive services definitely does not meet minimum value, even based on the calculator released by the Department of Health and Human Services (HHS). It returns a minimum value calculation of less than 12%, far below the required 60%.

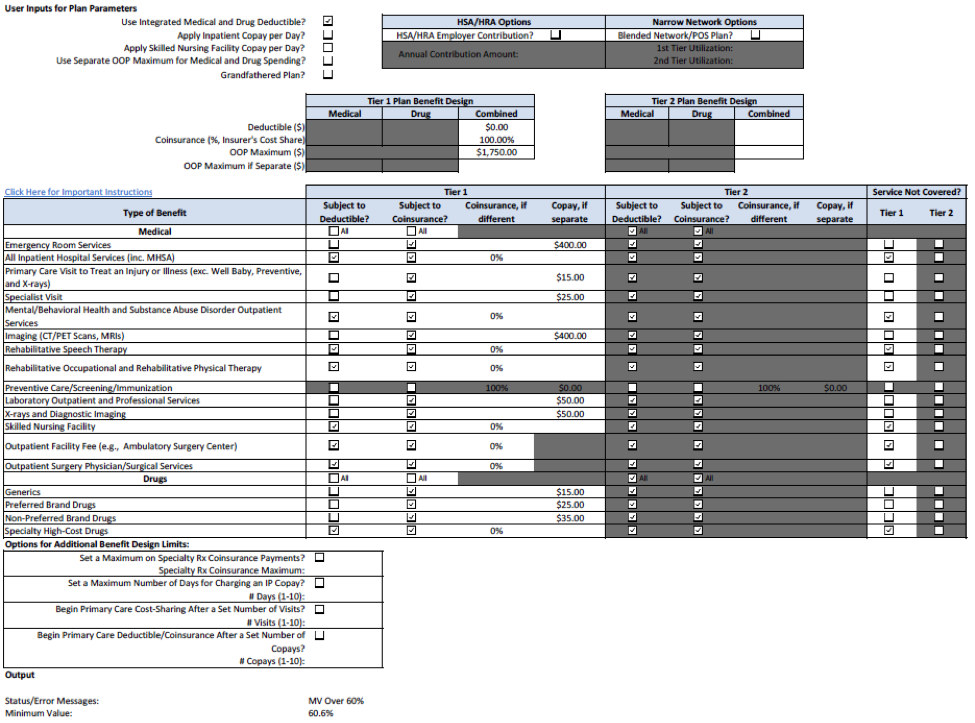

There seems to be much confusion though, with plans that do not cover inpatient hospitalization services. If you are only basing their value on the HHS minimum value calculator, they barely pass with a 60.6% value, as seen below in Picture 1. However, the Internal Revenue Service (IRS), who is tasked with enforcing the employer fines, has stated in IRS Notice 2012-31 that plans that do not cover the four core categories of coverage “would not satisfy any of the design-based safe harbors.” The four core categories they reference include physician and mid-level practitioner care, hospital and emergency room services, pharmacy benefits, and laboratory and imaging services.

Is it possible that there are technical issues with the HHS minimum value calculator? Quite likely. The first version of the calculator that was released did not calculate properly unless you ran the plan through a second time.

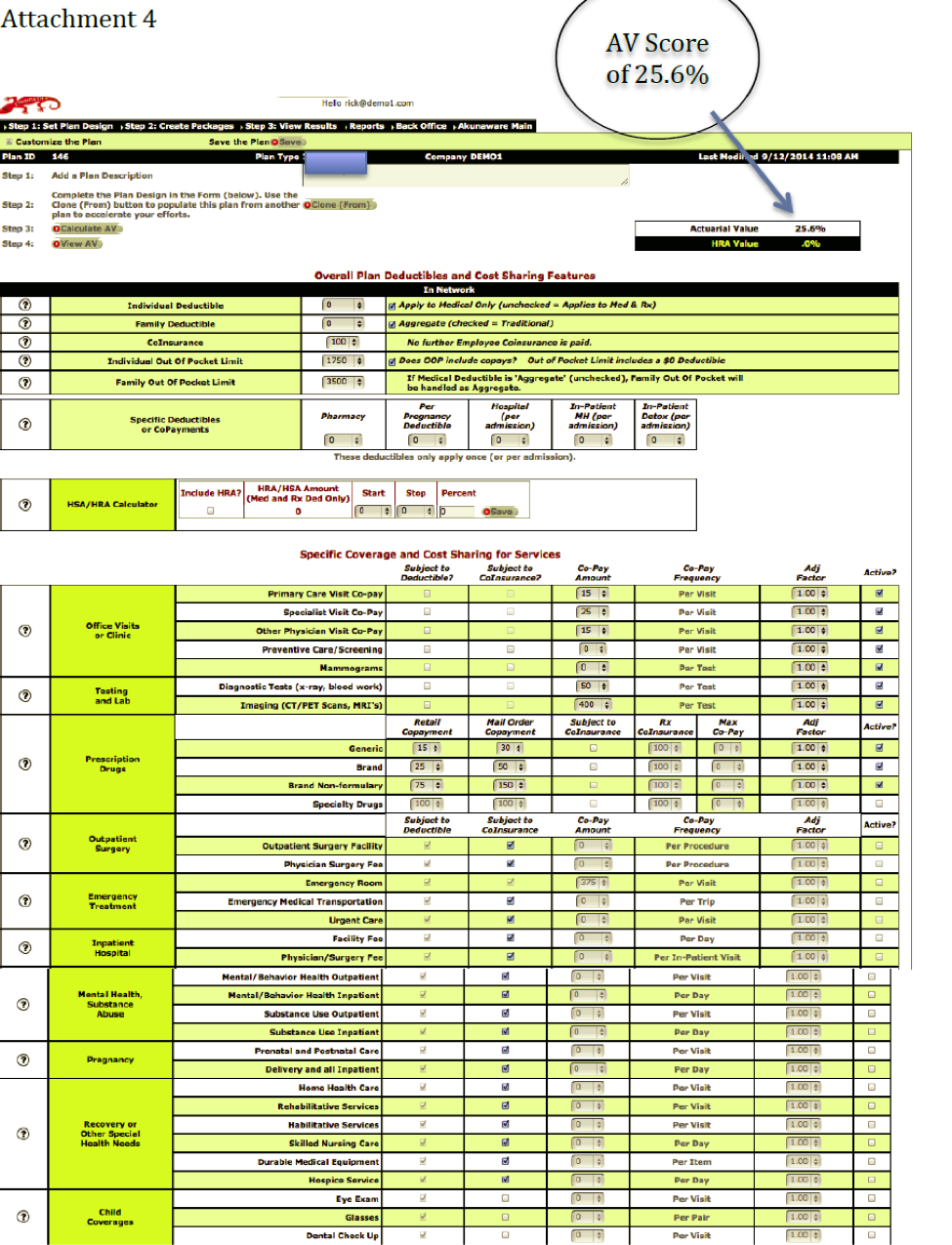

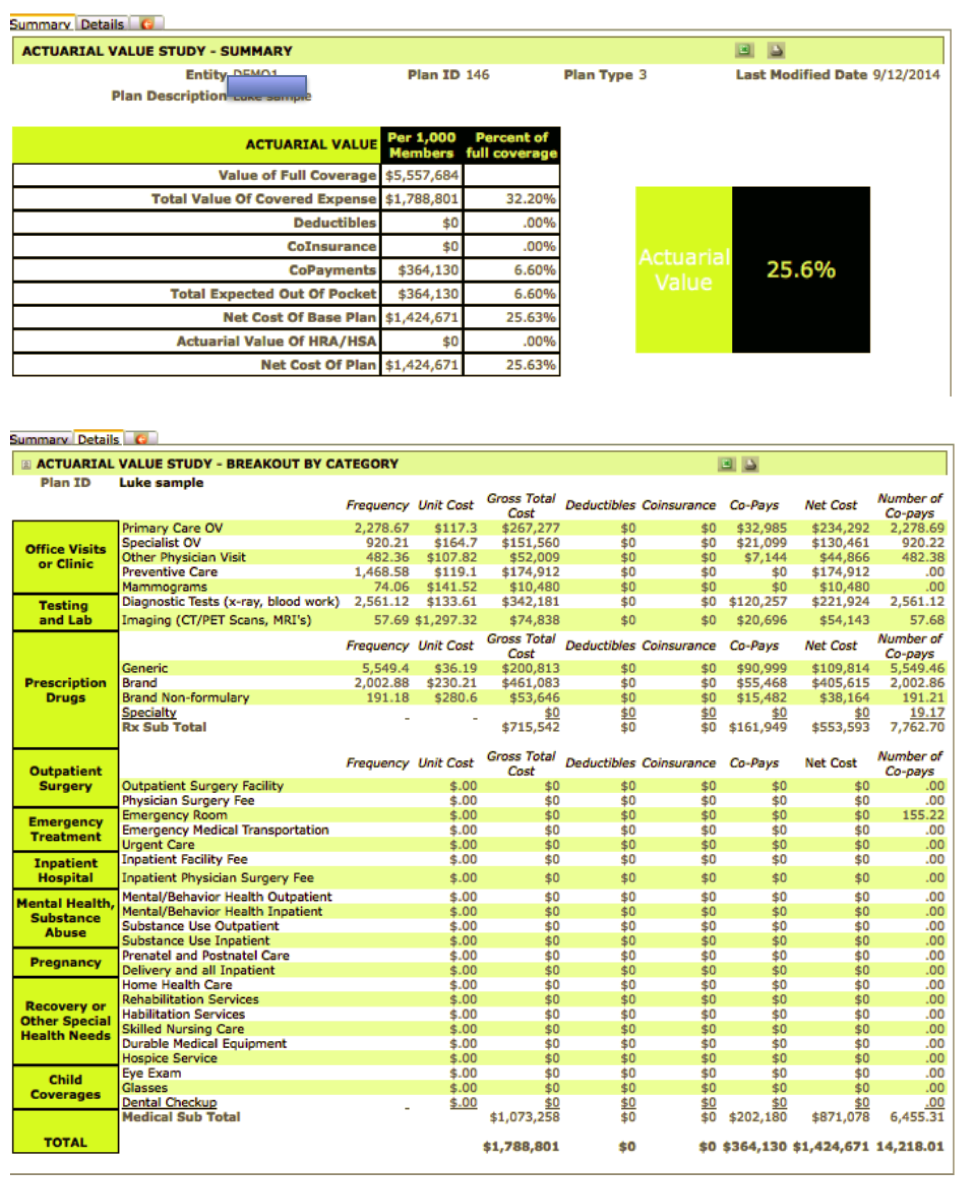

Actuaries believe that the skinny plans don’t pass the minimum value test. Using ClearPATH, a commercial grade actuarial value calculator developed by actuary Richard Burd, the same plan that passes the HHS calculator, fails the minimum value score with a mere 25.6% value. Pictures 2 and 3 show the details, using the same benefit design as shown in the HHS calculator. The ClearPATH input screen follows the benefits as outlined in a summary of benefits and coverages (SBC), with total transparency on cost assumptions, and is available from Contribution Health, in Lancaster, PA, or their software partner, Total Compensation Systems. It is interesting to note that other actuary models also place the value of these plans in the same range as ClearPATH.

Employers should approach these plans with extreme caution. Since the IRS is the agency that will levy the fines for those employers with more than 50 full-time equivalent employees that do not offer affordable, minimum value coverage, their own regulatory guidance should bear more weight.

Employers also should keep in mind they could be opening up potential liability for lawsuits under the Employee Retirement Income Security Act (ERISA). If HHS were to change, or in some views correct, their system, the employees would have made decisions based on not having all the correct information. They would have relied on their employer to supply them with that. If the employer did not perform their due diligence, not only would they be opening the door for potential lawsuits from employees, but IRS fines would also be levied. Unless the IRS also released transitional relief, these changes could occur in the middle of a plan year. With mandatory 60-day advance notice requirements of off-renewal changes, this could prove quite costly for an employer.

If faced with making that decision now, employers should always err on the side of caution.

Image 1:

Image 2:

Image 3:

IRS RELEASES NOTICE 2014-55 PROVIDING FOR ADDITIONAL

MARKETPLACE ELECTIONS

September 21, 2014

The first situation involves a participating employee whose hours of service are reduced so that the employee is expected to average less than 30 hours of service per week but for whom the reduction does not affect the eligibility for coverage under the employer’s group health plan. This may occur, for example, under certain employer plan designs intended to avoid any potential assessable payment under Code Section 4980H. To be eligible for this situation, an individual must met two conditions:

1. The employee has been in an employment status under which the employee was reasonably expected to average at least 30 hours of service per week and there is a change in that employee’s status so that the employee will reasonably be expected to average less than 30 hours of service per week after the change, even if that reduction does not result in the employee ceasing to be eligible under the group health plan; and

2. The revocation of the election of coverage under the group health plan corresponds to the intended enrollment of the employee, and any related individuals who cease coverage due to the revocation, in another plan that provides minimum essential coverage with the new coverage effective no later than the first day of the second month following the month that includes the date the original coverage is revoked.

The second situation involves an employee participating in an employer’s group health plan who would like to cease coverage under the group health plan and purchase coverage through a Marketplace without that resulting either in a period of duplicate coverage under the employer’s group health plan and the coverage purchased through a Marketplace or in a period of no coverage. To be eligible for this situation, an individual must meet two conditions:

1. The employee is eligible for a Special Enrollment Period to enroll in a Qualified Health Plan through a Marketplace pursuant to guidance issued by the Department of Health and Human Services and any other applicable guidance, or the employee seeks to enroll in a Qualified Health Plan through a Marketplace during the Marketplace’s annual open enrollment period; and

2. The revocation of the election of coverage under the group health plan corresponds to the intended enrollment of the employee and any related individuals who cease coverage due to the revocation in a Qualified Health Plan through a Marketplace for new coverage that is effective beginning no later than the day immediately following the last day of the original coverage that is revoked.

In both situations, a cafeteria plan may rely on the reasonable representation of an employee who has an enrollment opportunity for a Qualified Health Plan through a Marketplace that the employee and related individuals have enrolled or intend to enroll in a Qualified Health Plan for new coverage that is effective beginning no later than the day immediately following the last day of the original coverage that is revoked.

This notice permits a cafeteria plan to allow an employee to revoke his or her election under the cafeteria plan for coverage under the employer’ s group health plan (other than a flexible spending arrangement (FSA)) during a period of coverage in each of those situations provided two conditions are met. The Treasury Department and the IRS intend to modify the regulations under Section 125 consistent with the provisions of this notice, but taxpayers may rely on this notice immediately.

For a copy of IRS notice 2014-55, please click on the link below:

NEW CHIP DOCUMENTS FOR 2014

Remember to call our office if you did not receive our email with the updated information!!!

NEW MODEL COBRA NOTICES FOR 2014 – DID YOU UPDATE YOURS?

Remember to call our office if you did not receive our email with the updated information!!!

Changes to major Obamacare provisions progress

Of course, the troubles of small businesses and individuals are foremost on the minds of the insurance producers seeking solutions for their clients. Help may be on the horizon on both fronts, however.

David Shore, president of the Massachusetts Association of Health Underwriters, has found that many insurers provide just “limited network plans,” which makes it difficult for low-income and chronically ill employees to find and afford appropriate providers.

David Shore, president of the Massachusetts Association of Health Underwriters, has found that many insurers provide just “limited network plans,” which makes it difficult for low-income and chronically ill employees to find and afford appropriate providers.

Indeed, a December study from consultant McKinsey & Co. found more than two-thirds of health plans offered on the exchange have assembled provider networks considered “narrow” or “ultra-narrow.” In these networks, as many as 70% of hospitals and other local health providers aren’t included.

Even when insurers boast a wide network, the sale is difficult, said Steven Hurd of Pacific Insurance Brokers in California.

“A lot of times, people go for name recognition and they don’t know that smaller regionals are actually able to offer excellent value,” Hurd said. “Down here in San Diego, Sharp offers a lot of value, but people aren’t used to them and don’t want to figure out where those directories are and the nuances of putting people in there.”

That’s why the Health and Human Services Department felt prompted to issue a letter to insurers, urging them to cover 30% of “essential community providers” come 2015. That’s an increase from the 20% required this year.

The HHS also said it would review insurers’ provider networks to ensure they provide “reasonable access” to healthcare, including federally funded health clinics, safety-net hospitals and other medical providers commonly used by low-income individuals. Robert Zirkelbach, a spokesman for America’s Health Insurance Plans (AHIP), told Bloomberg the nation’s insurers were willing to comply with the request.

“It is important to ensure patients can continue to bebefit from the high-value provider networks health plans have established, which are helping to improve quality and mitigate cost increases for consumers as the new healthcare reforms are taking effect,” Zirkelbach said.

As for the 30-hour work week, would-be ACA reformers on the House Ways and Means committee advanced a bill that would change the law’s definition of a full-time worker to those who work 40 hours per week.

The legislation, which was passed on a vote of 23-14, will be referred to the House for consideration.

Mark Brown of Illinois-based M. Brown and Associates said the current definition of full time work has several of his clients in a bind.

“The business needs to survive, so what do you do? I have a client who bought up a company a year ago who needs to insure 50 to 70 people and there is no money to do it,” Brown said. “I feel really bad—what do you do for a guy like this? Make all 70 employees under 30 hours? Then nothing would get done.”

The HHS proposal is still in draft form, while the House bill must now be scheduled for debate.

WINDSOR DECISION AND SAME-SEX GUIDANCE RELATING TO PRE-TAX, ENROLLMENT, FSA, HDHP’S, ETC.

VERY IMPORTANT INFORMATION IF YOU HAVE SAME-SEX MARRIED EMPLOYEES

The following questions and answers provide further guidance on the application of the Windsor decision with respect to certain rules governing the federal tax treatment of certain types of employee benefit arrangements.

Mid-Year Election Changes

Q-1: If a cafeteria plan participant was lawfully married to a same-sex spouse as of the date of the Windsor decision, may the plan permit the participant to make a mid-year election change on the basis that the participant has experienced a change in legal marital status?

A-1: Yes. A cafeteria plan may treat a participant who was married to a same-sex spouse as of the date of the Windsor decision (June 26, 2013) as if the participant experienced a change in legal marital status for purposes of Treas. Reg. § 1.125-4(c). Accordingly, a cafeteria plan may permit such a participant to revoke an existing election and make a new election in a manner consistent with the change in legal marital status. For purposes of election changes due to the Windsor decision, an election may be accepted by the cafeteria plan if filed at any time during the cafeteria plan year that includes June 26, 2013, or the cafeteria plan year that includes December 16, 2013.

A-1: Yes. A cafeteria plan may treat a participant who was married to a same-sex spouse as of the date of the Windsor decision (June 26, 2013) as if the participant experienced a change in legal marital status for purposes of Treas. Reg. § 1.125-4(c). Accordingly, a cafeteria plan may permit such a participant to revoke an existing election and make a new election in a manner consistent with the change in legal marital status. For purposes of election changes due to the Windsor decision, an election may be accepted by the cafeteria plan if filed at any time during the cafeteria plan year that includes June 26, 2013, or the cafeteria plan year that includes December 16, 2013.

A cafeteria plan may also permit a participant who marries a same-sex spouse after June 26, 2013, to make a mid-year election change due to a change in legal marital status.

Any election made with respect to a same-sex spouse (and/or the spouse’s dependents) must satisfy the requirements of the regulations concerning election changes generally, including the consistency rule under Treas. Reg. § 1.125-4(c)(3).

Q-2: May a cafeteria plan permit a participant with a same-sex spouse to make a mid- year election change under Treas. Reg. § 1.125-4(f) on the basis that the change in tax treatment of health coverage for a same-sex spouse resulted in a significant change in the cost of coverage?

A-2: A change in the tax treatment of a benefit offered under a cafeteria plan generally does not constitute a significant change in the cost of coverage for purposes of Treas. Reg. § 1.125-4(f). Given the legal uncertainty created by the Windsor decision, however, cafeteria plans may have permitted mid-year election changes under Treas. Reg. § 1.125-4(f) prior to the publication of this notice.

As noted in Q&A-1 above, such an election change would have been permitted on the basis that the participant experienced a change in legal marital status. Accordingly, for periods between June 26 and December 31, 2013,a cafeteria plan will not be treated as having failed to meet the requirements of section 125 or Treas.Reg. § 1.125-4 solely

More ACA-Related Delays as Uncertainty Grows: Several More States

Announce Follow-Up to Proposed Cancellation Fix by Administration

According to several media outlets, federal officials have announced two more delays in implementing the Affordable Care Act (ACA) in the past week. First, the deadline to purchase coverage beginning January 1, 2014 was delayed by over a week, and second, the 2015 open enrollment period has been delayed a month. These two delays follow a string of postponements and adjustments to the law over the past several months. Delay for Those Seeking Coverage January 1 On November 22, the New York Times reported that a spokesperson for the Centers for Medicare and Medicaid Services (CMS) announced consumers would have an additional eight days to sign up for a plan that will go into effect on January 1, 2014. Until the announcement, consumers had until December 15 to choose a plan. Now, they will have until December 23. Following the difficulties that many people have had enrolling though the new Exchanges, the additional time may help some consumers comply with the Individual Mandate, which requires almost all Americans to have coverage by January 1. The spokesperson said “this extension will give consumers more time to review plan options, to talk with their families, providers or enrollment assisters and to enroll in a plan.” The delay could cause problems for carriers, however, since they will now have only nine days from when consumers sign up until they must be enrolled. Given the issues that the Exchanges have had transferring consumer information to insurance carriers, this short timeframe could prove difficult. A spokesman for America’s Health Insurance Plans (AHIP) said the delay “makes it more challenging to process enrollments in time for coverage to begin on January 1.” 2015 Open Enrollment Delay The New York Times also reports that White House spokesman Jay Carney announced a delay and extension of the planned 2015 open enrollment period for health plans offered on the insurance Exchanges. The initial plan was to hold open enrollment October 15-December 7, 2014 for the 2015 plan year. The new period will be November 15, 2014-January 15, 2015, allowing a full two months for consumers to enroll in the plan of their choice. The new enrollment availability is much shorter than the Exchanges’ inaugural 2014 period, which is lasting six months. Carney made clear that the open enrollment delay will allow insurance carriers more time to better plan for premium rates in 2015, giving them until late May 2014 to submit applications. Critics have been quick to point out that the new delay pushes the open enrollment period past the 2014 midterm elections. They argue that the delay is an attempt to avoid a repeat of the problematic 2014 open enrollment, and shield consumers from potentially high premium rates until after voters go to the polls. More Delays Possible These two delays follow several more consequential developments in the ACA’s implementation over the past two months. It is interesting to note that the announcement of these delays were informal, with the information emerging from press conferences and media inquiries. There has been no formal guidance related to the changes yet. Brokers should not be surprised by further changes of this kind. The ACA will continue to face challenges going forward and we will continue to keep you informed of the latest information and help anticipate any potential changes in the future.

IMPORTANT UPDATE ON INDIVIDUAL CANCELLATIONS

Update 11/26: Several states have announced their decisions regarding the “cancellation fix” that would allow insurers to continue to offer current plans (other than those that were previously grandfathered) through 2014. According to Kaiser Health News, states adopting the fix are: Arkansas, Colorado, Florida, Georgia, Hawaii, Iowa, Kentucky, Maryland*, Mississippi, Montana, North Carolina, Ohio, Oklahoma, Oregon, South Carolina, Texas, West Virginia, and Wyoming. *Maryland Insurance Commissioner Therese Goldsmith informed insurers that they can renew non-ACA-compliant policies, but only if they take effect before January 1, 2014. State law prevents these policies from being renewed after that date. States that will not adopt the fix are: California, Indiana, Massachusetts, Minnesota, New York, Rhode Island, Vermont, and Washington.

HRA AND 90 DAY WAITING PERIOD CHANGES

related to flexible spending accounts (FSAs) and HRAs. As such, this Alert is the first of two covering Notice 2013-54 which spells out requirements for HRAs offered starting January 1, 2014.

related to flexible spending accounts (FSAs) and HRAs. As such, this Alert is the first of two covering Notice 2013-54 which spells out requirements for HRAs offered starting January 1, 2014.|

Plan Type

|

Subject to

Annual

dollar limit prohibition?

|

Subject to preventive services requirements?

|

Regulatory Status

|

Next Steps

|

| Standalone HRA (i.e., reimburses individual market premiums) for active employees | Yes | Yes | Fails to satisfy annual dollar limit prohibition and preventive services requirement | Plan must be terminated. If it also pays for out-of-pocket §213(d) health care expenses, balances can be continued to be used until depleted. |

| Standalone retiree HRA (can be used for individual premiums and/or out-of-pocket §213(d) health care expenses | No | No | A standalone retiree HRA provides minimum essential coverage (which renders participant ineligible for premium tax credits) | Plan must be amended to allow for an annual and permanent opt out of reimbursements to enable eligibility for the premium tax subsidy. |

| HRA that is in conjunction with a group health plan that is ACA-compliant | Yes, but satisfies the condition only if integrated with an underlying ACA-compliant health plan. | Yes, but satisfies the condition only if integrated with an underlying ACA-compliant health plan. | Satisfies the annual dollar limit prohibition and preventive services requirements | |

| HRA to comply with SFHCO or other government or tribal requirement | Yes | Yes | Fails to satisfy annual dollar limit prohibition and preventive services requirement | Plan must be terminated, however these can continue until the later of January 1, 2014 or the first day of the plan year following the close of a regular legislative session after September 13, 2013. |

FSA, HSA AND POP PLANS

- Only individuals eligible for employer-provided major medical coverage can be offered the health FSA. Employers with health FSAs must have an underlying ACA-compliant group health insurance plan. As an example, XYZ Co. offers a health FSA to full-time employees and part-time employees. However; the part-time employee population is not eligible to enroll in XYZ Co.’s major medical plan. Under this scenario, part-time employees can no longer enroll in an FSA. An amendment is required to XYZ Co.’s Plan Document to remove this group as eligible employees under the FSA.

- In addition, the health FSA must limit the maximum payable to 2 times the participant’s salary reduction or, if greater, the participant’s salary reduction plus $500. What does this mean? Simply that health FSAs can include employer contributions of $500 or up to a dollar for dollar match of each participant’s election.

| Plan | Next Steps |

| Premium Only Plan – Fiscal Year Plans (example July 1 – June 30) | Amend your Plan Documents to allow a one-time qualifying event giving permission for employees to enroll in the Exchange and opt out of their current health insurance plan and the premium only portion of the cafeteria plan. |

| January 1, 2014 Health FSAs and Premium Only Plans | Amend your plan to adjust the waiting period so that it is not more than 90 days (in most states). The waiting period adopted should be the same as the underlying insurance plan or for FSAs can be longer but in no case a shorter waiting period than the underlying health insurance plan. |

| Plan Type | Subject to Annual dollar limit prohibition? | Subject to preventive services requirements? | Regulatory Status | Next Steps |

| Excepted benefit health FSA | No | No | Not subject to the annual dollar limit prohibition and preventive services requirement, and does not provide minimum essential coverage (participant remains eligible for premium tax credits) | Consider employer contributions to $500 or matching a maximum of $1 for every dollar elected by the participants. |

| Non-excepted benefit health FSA funded under a 125 cafeteria plan | No | Yes | Fails to satisfy the preventive services requirement | Plan must be terminated. |

| Non-excepted benefit health FSA not funded under a 125 cafeteria plan | Not yet determined | Yes | Fails to satisfy the preventive services requirement; may also fail the annual dollar limit prohibition | Plan must be terminated. |

| After-tax employee contributions which participant may use to purchase individual market coverage | No | No | An arrangement under which after-tax employee contributions may be used to purchase individual market coverage and are structured as an employer payroll practice are permissible. | |

| Pre-tax employee contributions which participant may use to purchase individual market coverage | Yes | Yes | Fails to satisfy annual dollar limit prohibition and preventive services requirement | Plan must be terminated. |

Change to FSA “Use It or Lose It” Provision

On Thursday, October 31, 2013, the Department of Treasury announced a major policy change that will impact Flexible Spending Account (FSA) plans. In what is being hailed as a hugely positive development for administrators, employers, and FSA participants, the Treasury has modified the “use it or lose it” provision to allow for a limited rollover of FSA funds.

Details are as follows:

Details are as follows:

- Effective for the 2014 plan year, employers will have the option to allow FSA plan participants to roll over up to $500 of unused funds at the end of the plan year.

- Effective immediately, employers with an FSA plan that does not include a grace period will have the option to allow current FSA plan participants to roll over up to $500 of unused funds at the end of the 2013 plan year.

The new guidance, as issued by the IRS, can be found here.

New Jersey FamilyCare (NJFC)

Program Description

New Jersey FamilyCare (NJFC) is a federal and state funded health insurance program created to help New Jersey’s uninsured children to have affordable health coverage. It is not a welfare program. NJFC is for hard-working families who cannot afford to privately pay the high cost of health insurance. Eligibility is based on family size and monthly income. Assets are not considered when determining eligibility. NJFC is a comprehensive health insurance program that will provide many if not all of your child’s health care needs. A sample of the services provided by NJFC are: physician services, preventive health care, emergency medical care, inpatient hospital services, outpatient hospital services, laboratory services, prescription drugs, eyeglasses, dental services in most cases, emergency transportation, mental health services, plus many more.

Important Information about the Employee Notice of Coverage Options

The Department of Labor (DOL) has issued temporary guidance about the Employee Notice of Coverage Options, formerly the Notice of the Exchange. Additional information on the Notice is provided below. Employers are not required to provide Notices under this temporary guidance. If they prefer, employers can wait until formal guidance is provided later this year.

Temporary Guidance Refresher and Self-Service Resources

Employers must indicate on the Notice whether the plan meets these criteria by checking a box that states, “If checked, this coverage meets the minimum value standard, and the cost of this coverage to you is intended to be affordable, based on employee wages.

REQUIRED MODEL NOTICES UNDER PPACA FOR THOSE OFFERING AND NOT OFFERING EMPLOYEE HEALTH INSURANCE

Please be advised that the notices below MUST go out to ALL employees, whether or not you are offering health insurance. There is a notice for both, as per below. These are MODEL NOTICES, so please transcribe onto your letterhead and be sure each employee receives a copy. Many employers are putting a packet of mandates together and having each employee confirm receipt with a signature and date. For employers who offer a health plan to some or all employees http://www.dol.gov/ebsa/pdf/FLSAwithplans.pdf For employers who do not offer a health plan http://www.dol.gov/ebsa/pdf/FLSAwithoutplans.pdf ___________________________________________________________________________________________________________ Federal Labor Laws by Number of Employees 1-14 EMPLOYEES Fair Labor Standards Act (FLSA) (1938) Immigration Reform & Control Act (IRCA) (1986) Employee Polygraph Protection Act (EPPA) (1988) Uniformed Services Employment & Re-employment Rights Act (USERRA) (1994) Equal Pay Act (EPA) (1963) Consumer Credit Protection Act (1968) National Labor Relations Act (NLRA) (Wagner Act) (1935) Labor-Management Relations Act (Taft-Hartley Act) (1947) Employee Retirement Income Security Act (ERISA) (1974) Federal Insurance Contributions Act (FICA) (1935) Occupational Safety & Health Act (OSH Act) (1970) Note: Employers with 10 or fewer employees and business establishments in certain industry classifications are partially exempt from keeping OSHA injury and illness records. Health Insurance Portability and Accountability Act (HIPAA) (1996) Jury System Improvements Act (1978) Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) (1996) Fair Credit Reporting Act (FCRA) (1970) Fair and Accurate Credit Transactions Act (FACTA) (2003) 15+ EMPLOYEES ALSO NEED TO COMPLY WITH: Title VII, Civil Rights Act (Title VII) (1964) (1991) Title I, Americans with Disabilities Act (ADA) (1990) Pregnancy Discrimination Act (1978) Genetic Information Nondiscrimination Act (GINA) (2008) 20+ EMPLOYEES ALSO NEED TO COMPLY WITH: Age Discrimination in Employment Act (ADEA) (1967) Consolidated Omnibus Budget Reconciliation Act (COBRA) (1985) Note: Group health plans sponsored by employers with 20 or more employees, including both full and part-time employees, on more than 50% percent of their typical business days in the previous calendar year are subject to COBRA (each part-time employee counts as a fraction of an employee, equal to the number of hours the part-time employee worked divided by the hours an employee must work to be considered full time)